18 Feb Harami Candlestick Chart Pattern Bearish and Bullish

Harami candlestick patterns indicate a trend reversal in the underlying market price of an asset. The Harami Japanese candlestick pattern can occur in both bullish and bearish markets, which means that the formation can be useful in any environment. A bullish Harami pattern indicates an upward price reversal, whereas the bearish Harami pattern indicates a downward price reversal may be possible. Bullish and bearish haramis are among a handful of basic candlestick patterns, including bullish and bearish crosses, evening stars, rising threes, and engulfing patterns.

Let’s take a look at a simple example that a day trader could have profited handsomely off of. During a bullish move, the harami candlestick indicator tells us that strength in the previous candle is dissipating. A bullish Harami occurs at the bottom of a downtrend when there is a large bearish red candle on Day 1 followed by a smaller bearish or bullish candle on Day 2. In this article, we’ve had a look at the bearish harami pattern, covered its meaning, and also shown you how to improve the performance of the pattern. Applied to the bearish harami pattern, you could demand that the ranges of the candles making up the pattern are bigger than the surrounding ranges. That would suggest that more market participants took part in forming the pattern, which increases its significance.

Multiple Candlestick Patterns (Part

This is the signal we were waiting for in order to close our trade. We exit the position and collect a profit of $.30 cents per share for 25 minutes of work. After a steady price increase, a bearish harami develops which is shown in the green circle on the chart. At the same time, the stochastic at the bottom of the chart has already been in the overbought area for about 7 periods.

Technical Classroom: How to read Bullish Harami and Bearish Harami patterns – Moneycontrol

Technical Classroom: How to read Bullish Harami and Bearish Harami patterns.

Posted: Sun, 14 Oct 2018 07:00:00 GMT [source]

Harmonic patterns are used in technical analysis that traders use to find trend reversals. According to the book Encyclopedia of Candlestick Charts by Thomas Bulkowski, the Evening Star Candlestick is one of the most reliable of the candlestick indicators. It is a bearish reversal pattern occurring at the top of an uptrend that has a 72% chance of accurately predicting a downtrend.

Read more on Trading with Harami Candlesticks

As the name suggests, it has it is made up of a large bullish or bearish candle that is followed by a smaller one of the opposite colour. Here is a chart below where the encircled candles depict a bullish harami pattern, but it is not. The prior trend should be bearish, but in this case, the prior trend is almost flat, which prevents us from classifying this candlestick pattern as a bullish harami. In both instances the candle labelled ‘3’ designates the confirmation candle which approves the pattern. With most candlestick patterns, traders can utilise other technical indicators to support the pattern.

- Once you receive this additional signal, open a trade – a short position in our case.

- And here is another example where a bullish harami occurred, but the stoploss on the trade triggered a loss.

- Still, identifying the candlestick pattern is not always a guarantee that the reversal pattern will happen.

- Other times we just compare the volume of today to the volume of the previous bar.

One should rely on the chart patterns, candle patterns, support and resistance, and so on. As the harami candle itself a price action component one should always include the price action strategy option in our analysis. The first candlestick is referred to as the “mother” with a large real body that embodies the smaller second candlestick, and thus creating the visual of a pregnant mother. Recently, we discussed the general history of candlesticks and their patterns in a prior post. We also have a great tutorial on the most reliable bullish patterns. When you spot a Harami candlestick pattern, the key here is to use the moving average to set an entry point.

Strategy 1: Bullish Harami and Volatility Filter

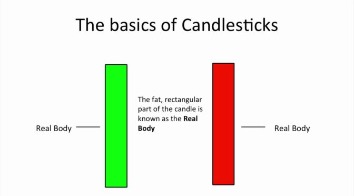

Sellers are dominating the market, and buyers wait for a signal that the bearish trend has come to an end. Second, you should then look closely at the movement of the candlesticks and identify when a large candlestick is followed by a small candle. For the pattern to happen, the smaller candle must be completely engulfed by a larger one. And here is another example where a bullish harami occurred, but the stoploss on the trade triggered a loss. The risk-averse will initiate the trade the day near the close of the day after P2, provided it is a blue candle day, which in this case is. The filled or hollow portion of the candle is known as the body or real body, and can be long, normal, or short depending on its proportion to the lines above or below it.

Elearnmarkets (ELM) is a complete financial market portal where the market experts have taken the onus to spread financial education. ELM constantly experiments with new education methodologies and technologies to make financial education effective, affordable and accessible to all. The price is held up by the buyers and is unable to fall to the bearish close of Day 1. This trade brought us a profit of $.77 cents per share in less than an hour. However, the blue lines at the end of the chart show how the price confirms a double bottom pattern. The double bottom is an early indication that price is likely to stabilize and lead to a potential rally.

How to Identify a Bullish Harami on Trading Charts

When the harami candlestick pattern appears, it depicts a condition in which the market is losing its steam in the prevailing direction. The harami candlestick pattern consists of a small real body that is contained within the preceding large candles’ real body. A bearish harami is a two bar Japanese candlestick pattern that suggests prices may soon reverse to the downside. The pattern consists of a long white candle followed by a small black candle. The opening and closing prices of the second candle must be contained within the body of the first candle.

A bullish harami is made of a large bullish candlestick that is followed by a small bearish candlestick. On the other hand, a bearish harami is made up of a large bearish candle that is followed by a small bullish candle. The Harami that means “pregnant” in Japanese is multiple candlestick patterns is considered a reversal pattern. One point to note is that these four trading strategies can be used in combination with all other candlestick reversal patterns. The size of the second candle determines the pattern’s potency; the smaller it is, the higher the chance there is of a reversal occurring.

- Additionally, the harami candles have a close resemblance to an engulfing candle.

- The lines above and below, known as shadows, tails, or wicks, represent the high and low price ranges within a specified time period.

- It is a bearish reversal pattern occurring at the top of an uptrend that has a 72% chance of accurately predicting a downtrend.

Below are some of the advantages and limitations of this pattern. The bullish harami belongs to the category of most popular candlestick patterns and is relied upon by many traders in their analysis of the markets. For expert traders, this would be a strong signal to sell the asset through the initiation of short positions. The first candle is usually long, and the second candle has a small body. The second candle is generally opposite in colour to the first candle.

Now that we have covered the basics of the https://g-markets.net/ pattern, it’s now time to dive into tradeable strategies. Please note all of the subsequent examples are on a 5-minute time frame, but the rules apply to other time frames just as well. For a bearish harami cross, some traders prefer waiting for the price to move lower following the pattern before acting on it. In addition, the pattern may be more significant if occurs near a major resistance level. Other technical indicators, such as an RSI moving lower from overbought territory, may help confirm the bearish price move.

What is a Bullish Harami Pattern?

As the name suggests, the bullish harami is a bullish pattern appearing at the bottom end of the chart. The bullish harami pattern evolves over a two day period, similar to the engulfing pattern. If you’re interested in mastering some simple but effective swing trading strategies, check out Hit & Run Candlesticks.

But the important point was the fact that we saw other candlestick formations confirm what the harami cross was telling us. It is characterized by having a very small real body almost to the point of being a doji. A sell signal could be triggered when the day after the bearish Harami occurred, the price fell even further down, closing below the upward support trendline. When combined, a bearish Harami pattern and a trendline break might be interpreted as a potential sell signal. With this strategy example, we wanted to show the possibilities of using volume to improve on the accuracy of the pattern.

What is a Marubozu Candlestick?

Trading foreign exchange on margin carries a high level of risk, as well as its own unique risk factors. Options are not suitable for all investors as the special risks inherent to options trading may expose investors to potentially rapid and substantial losses. Prior to trading options, you should carefully read Characteristics and Risks of Standardized Options. Spreads, Straddles, and other multiple-leg option orders placed online will incur $0.65 fees per contract on each leg. Orders placed by other means will have additional transaction costs. All four strategies are great for trading candlestick reversal patterns like the harami.

No Comments